rhode island sports betting tax

The state receives 51 of the sports betting revenue generated. Rhode Island Sports Betting Laws.

Mass Senate Passes Sports Betting Bill Wbur News

Bovada Sportsbook - Up to 250 In Free Bonus Money For Rhode Island Residents.

. Dollars in tax revenue from sports betting up from approximately 18 million US. It was Senate Bill 2045 that officially brought sports betting into the legal realm in Rhode Island and the state collected 178 million in tax revenue from sports betting in 2019. Rhode Island Works.

Among the top providers of online sports betting services to the entire country this website has earned its. If you receive cash from a sports betting facility you will receive a total that already has taxes taken. Rhode Island Sports Betting Laws And Tax Rates.

10 rows Heres a look at Rhode Islands sports betting history. Rhode Island was one of the first states in the US to offer sports betting launching in 2018 via retail outlets. Rhode Island sports betting revenue in August rose by 1179 from July.

However the online odds are often better than the retail odds as only a 599 tax is applied to revenues. Put simply for every 100 in sports betting revenue Twin Rivers keeps 17 while Rhode Island grabs 51. The Rhode Island state follows the federal gambling law just like any other state meaning that there is a 25 tax being applied before local and state specific taxes.

You should also expect to pay another 24 in federal taxes. When it comes to taxes Rhode Island has adopted a revenue-sharing framework with the commercial casino operators. The Rhode Island Lottery Commission.

Rhode Island sports betting tax rates for betting operators are unusually high compared to other states. In March 2022 Rhode Island generated approximately 19 million US. In 1992 the federal government passed the Professional and Amateur Sports Protection Act through Congress.

This act effectively prohibited all but four. 21 rows New Hampshire decided on a monopoly grant to DraftKings which remits 51 of gross revenue for. Rhode Island Sports Betting Tax Revenue Booms In August.

Rhode Island Governor Gina Raimondo and some lawmakers began the process of legalizing sports betting in Rhode Island through a budgetary measure proposed in 2018. The Rhode Island Lottery takes 599 of all the total winnings. While it does not have this.

For more information you. Rhode Island applies taxes to all sports betting revenues whether online or in person. How to Pay The IRS Taxes on Sports Betting Silver Tax Group.

It is not unusual for Rhode Islands sports betting operators to pay. Rhode Island sports betting revenue sits at 738 million with the state receiving 376 million of that amount which works out to the 51 tax rate imposed on sports betting. Rhode Island sports betting revenue is taxed at a rate of 51.

Do You Have To Pay Sports Betting Taxes Smartasset

Three Tax Lessons From The First Year Of Widespread Legal Sports Betting Tax Policy Center

Monthly Sports Betting Tax Revenue In Rhode Island 2022 Statista

Income Taxes And Sports Betting In 2018 Taxact Blog

Report R I Has Received 53 5m In Sports Wagering Revenue Since 2018

Legalized Sports Betting May Not Be A Sure Thing For Rhode Island Rhode Island Monthly

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Big Pa Sportsbook Licensing Fees Mean Pa Budget Projections On Target

Esports Betting In Rhode Island Top Games Best Sportsbooks

How Will Legal Sports Betting Affect Your Income Taxes Credit Karma

Mobile Sports Betting In Louisiana Generates 2 2m In Taxes For February Louisiana Thecentersquare Com

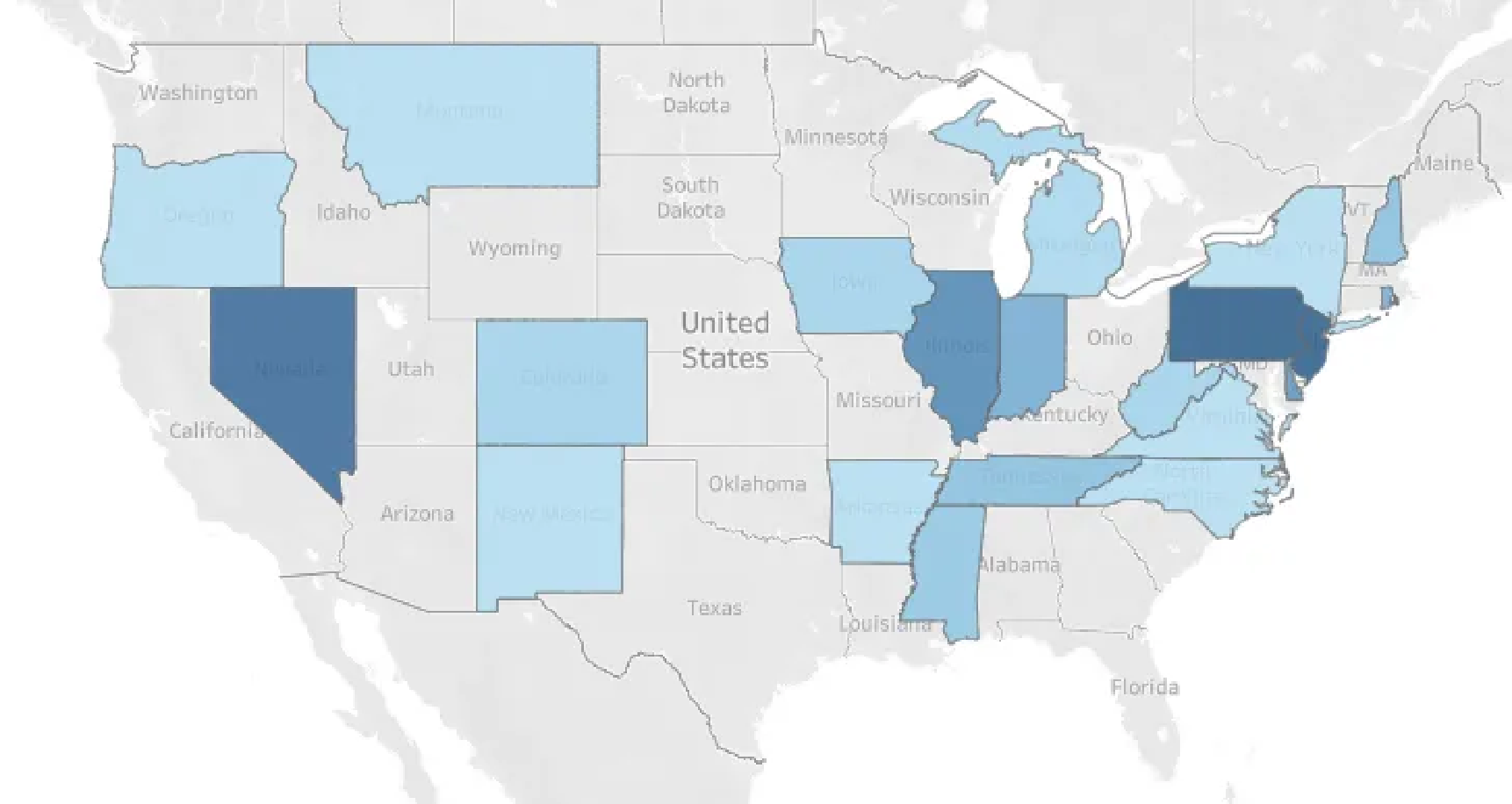

Gamblingmap 7a077708df4b89fa70cca4d608dd3fd1 Png

Best Rhode Island Sports Betting Sites 2022 Legal Sportsbooks In Ri

Rhode Island Sports Betting Sites Online Sports Betting In Rhode Island

Comparing Rhode Island And New Hampshire Sports Betting

What Other States Can Learn From Rhode Island As Sports Betting Expands In 2020